HIL Limited presents an investment opportunity driven by dual recovery factors: increased rural infrastructure spending in India and the revival of European markets through its Parador flooring business. The company targets $1 billion in revenue and 10-12% EBITDA margins over the next 3-4 years, backed by capacity expansions, operational efficiencies, and new product introductions. Despite challenges like fluctuating PVC resin prices and European economic pressures, HIL's strategic focus on diversification and innovation enhances its resilience. Its robust risk-reward profile, supported by reasonable valuations and prudent management, makes it well-positioned for long-term growth

However amidst the global and domestic macro challenges its remains to be seen that whether HIL’s strategic initiatives, including capacity expansion, product diversification, and geographic growth, effectively translate into achieving its ambitious $1 billion revenue and 10-12% EBITDA margin targets within the planned timeframe

Herein in this post I present my views based on a detailed analysis of HIL Limited

My view on risk reward profile and recommendation regarding HIL Limited

Risk/Reward: The risk-reward profile for HIL Limited appears favorable based on the valuation analysis. At the current enterprise value of 2,600 crores, achieving a 25% IRR would require the company to reach an enterprise value of approximately 6,600 crores through organic growth, without additional debt or equity dilution. Even in a conservative scenario where HIL achieves revenue of 7,000 crores with reduced EBITDA margins of 8% (generating EBITDA of 560 crores), the stock would need to trade at 12x EV/EBITDA multiple to reach the target enterprise value. Given that this multiple is reasonable for a company in HIL's sector and growth profile, the probability of achieving the targeted 25% IRR appears high. This valuation framework suggests an attractive risk-reward proposition, with the downside scenario still supporting reasonable returns based on conservative operating metrics.

(Note: I used price implied expectations approach (reverse DCF) to evaluate instead of SOTP because the relative multiples of Parador, Buildings segment, and Pipes & Fittings segment – are inflated due to no earnings and do not reflect any economic reality)

Investment Viewpoint:

The investment viewpoint for HIL Limited can be viewed from two distinct perspectives. For long-term investors who focus primarily on business fundamentals and management execution, HIL presents an attractive buying opportunity at current valuations, despite the possibility of experiencing extended periods without significant returns. However, from a more tactical investment approach that emphasizes price action and risk management over news flow, it would be prudent to wait for clear positive price momentum before making any substantial investment. This second approach acknowledges that while the business fundamentals may be improving, market validation through price action would provide additional confirmation before committing significant capital

(Disclaimer - Not invested or recommended, just tracking the stock right now)

About the HIL Limited:

HIL Limited, established in 1946, is a flagship company of the CK Birla Group and a leading player in the building materials industry. The company operates across multiple business segments, offering comprehensive building solutions. The company has manufacturing operations in 32 locations, a wide network of more than 3500 distributors and 21000 retailers.

Their top 4 business segments, with their revenue mix (total approx. INR 3600cr)

1) Pipes & Fittings (10%)

2) Flooring Solutions (Parador) (24%)

3) Building solutions (16%)

4) Roofing solutions (35%)

HIL’s transformation:

HIL Limited has significantly transformed its revenue composition over the past decade. Previously, the asbestos business contributed 80% of revenue, but this has decreased to 30%, with the remaining 70% coming from non-asbestos business. This shift demonstrates the company's strategic pivot towards more sustainable and diverse product offerings.

Recent updates and targets:

The company has set an ambitious target of becoming a $1 billion company by FY27-28, aiming for a 17-20% growth rate over the next 4-5 years. This growth strategy is underpinned by diversification into new product lines and expansion into international markets.

Over the recent few quarters, they have been taking a hit on their EBITDA margins, due to increased efforts on investments in people, advertising, and supply chain. The company has planned capex of INR 350-400 crores for FY25-26 (funded through debt – 270 crores, and internal accruals) for capacity expansion in pipes & fittings and building solutions, plus new product launches, innovation, and geographic diversification on Parador.

Assessment: Their roofing solutions segment exhibits high seasonality closely tied to monsoon and agricultural cycles in India

TTM revenues (consolidated) INR 3500 crores with OPMs of INR 60 crores.

Detailed business analysis: Based on CCCP and right to win.

A) Pipes & Fittings business (Polymer solutions):

HIL manufactures and sells various pipes and fittings under the Birla HIL brand. These products are used in plumbing, irrigation, and other infrastructure applications for residential, commercial, and industrial purposes. HIL also manufactures and sells wall putty, used for smoothing and finishing walls before painting.

Right to win:

· HIL is leveraging its strong brand reputation, operational excellence, and wide distribution network to establish itself as a key player in the pipes and fittings segment.

· Since HIL Limited has already well penetrated tier-2/3 cities under their roofing solutions, they can leverage their position in tier-2/3 towns, which is expected to trigger healthy growth in volumes of pipes & fittings.

· The company focuses on system sales rather than individual product sales, offering integrated solutions that appeal to B2B customers such as builders and contractors in these cities.

· These B2B customers like builders & contractors in tier-2/3 cities, are already well familiar with the Charminar Brand, so it should be easy to sell pipes & fitting products alongside.

· They are focusing on increasing their distribution reach and targeting technical sales in institutions by leveraging Crestia.

Analysis of business based on CCCP (Context, Customer, Competition, Product) analogy:

Context:

· HIL Limited operates in India's growing PVC pipes and fittings market, which is estimated at ₹55,000 crore.

· This market is driven by increasing infrastructure development, government initiatives like the Jal Jeevan Mission (JJM), and rising demand for plumbing and agricultural irrigation systems.

· HIL has strategically expanded its presence in this segment through acquisitions (Topline) and innovation (TrueFit leak-proof technology).

· They are targeting a volume growth of 25-30% and expecting a revenue of INR 1500 cr then scaling this to 2500cr with a sustainable EBITDA margin of 10-12%. Current capacity can generate revenue of 500-600 crores, with potential up to 1600 crores with additional investments.

· Acquired Cresta for INR 270cr (revenue of 350cr) which increased their manufacturing capacity by 83,500 MTPA in the east

Customer:

· Residential: Homeowners seeking durable and leak-proof plumbing solutions.

· Commercial and Builders: Builders and contractors requiring high-quality pipes for large-scale projects, triggered by government spending.

· The company also targets premium customers through value-added products like silent pipes and leak-proof solutions.

Competition:

· HIL faces competition from both organized players (e.g., Astral Pipes, Finolex Industries) and unorganized local manufacturers.

· Aggressive pricing from the incumbent players, eroded their margins

Products:

· uPVC Pipes: Durable, non-toxic alternatives to GI pipes for water supply.

· cPVC Pipes: Chlorinated PVC pipes for hot and cold-water applications

· SWR Pipes: Soil, waste, and rainwater management systems

· Silent Pipes: Low-noise drainage solutions with multi-layer designs

· Pressure Pipes: Used in irrigation and water distribution systems

· Column Pipes: High-strength pipes for borewell applications

1) What was the problem that led to the underperformance of the segment?

The sharp downtrend in PVC resin prices put the pressure on whole pipes and fittings industry which led to the downtrend in the prices of pipes. Cross-verify: Below is the P&L of Finolex Industries (India’s leading manufacturer of PVC pipes and PVC resins)

· (OPM declined from 28% in FY21 to 1% in FY24)

· Falling pipe prices led to delayed purchases from dealers and distributors, anticipating further price reductions coupled with a slowdown in spending from the government side, which led to the downtrend in volume growth, and the competitive pressure erased their margins.

· These competitive dynamics led to inventory losses due to holding higher-cost inventory

What steps were taken by the management to address the problem?

· The company is exploring alternative raw material recipes to reduce dependency on PVC resin and mitigate the impact of price fluctuations.

· They also have adopted prudent pricing strategies to pass on some of the increased costs to customers plus they are incorporating AI, IoT, and BI tools for better demand forecasting and procurement of raw materials to avoid overstocking during periods of extreme price volatility.

· The company is introducing new SKUs (stock-keeping units) to cater to diverse customer needs, which helps mitigate the impact of price fluctuations by targeting different market segments.

· In the last 2 months, the RIL has increased the PVC resin prices, after a prolonged decline, suggesting a reversal in trend of declining prices.

· Astral Limited Concall – They expect that PVC prices will remain stable going forward, their expectations are that PVC prices have bottomed out.

3) What do markets want to see?

· Stabilization in PVC prices

· Improved spending from the government for demand recovery

· Margin recovery for HIL’s pipes and fittings segment

· Execution towards achieving INR 2500 crore topline in 3-4 years.

4) Key risks:

· Competition Pressure: Aggressive pricing by competitors can erode market share. The players in this industry largely competes on scale – thus there is constant risk of oversupply in the industry

· No improvement in government spending, delay in projects

5) Opinion:

· The industry’s margins and profitability are driven largely by economies of scale. Many players compete here based on the scale of production, which poses a constant threat of oversupply in the industry.

· While the worst of the performance is behind us, it does not mean a recovery.

B) Parador (flooring solutions):

Parador is HIL's flooring solutions business based in Europe, specializing in premium flooring products like laminate, engineered wood, and modular flooring. They sell to both DIY customers and Professional installers.

Parador’s right to win: Their approach and shift towards technology, and more choices to end consumer

· Parador was founded in 1977 and became a vertically integrated supplier of premium quality flooring solutions based in Germany.

· Premium Partnerships: Parador has associated with premium publications such as Elle Décor, Vistara In-flight Magazine, and Surface Reporter to position itself as a high-end brand (In the UK and EU). These partnerships help reach affluent customers who value design and quality.

· Room Designer Tool: Parador introduced an augmented reality (AR)-based Room Designer tool on its website, allowing customers to visualize flooring in their own spaces. Users can upload pictures of their rooms, and the tool digitally overlays the selected flooring, accounting for lighting conditions and furniture placement. This innovation makes the shopping experience personalized and engaging, addressing customer concerns about how flooring will look in real-life settings.

· Digital Point-of-Sale (POS): Parador equipped its retail partners with digital POS tools, including QR codes on samples that provide instant product information, pricing, and comparisons. This can enhance the decision-making process for high-value customers looking for premium products.

Analysis of the Parador’s business based on CCCP analogy:

Context:

· HIL entered the flooring solutions market through its acquisition of Parador in 2018. Parador is a premium German brand specializing in high-quality flooring products such as laminate, engineered wood, and vinyl flooring.

· Parador’s operations are based in Germany and Austria, with a strong presence across 80+ countries.

· Expecting to reach the topline of $500M in 3-4 years, with sustainable margins of 8-10% (highest was 12% in 2021)

· Going forward, the company has projected of doing a revenue of EUR 12-14 million per month (Q3FY24 concall)

Customer:

· Residential Customers: Homeowners seeking stylish, durable, and easy-to-maintain flooring options for living spaces

· Commercial Customers: Architects, interior designers, builders, and contractors working on large-scale projects like offices, hotels, or retail spaces.

Competition:

· Global Competitors: Tarkett, Mohawk Industries, Armstrong Flooring

· Regional Competitors: Smaller European brands in laminate or vinyl segments

Product:

· Laminate Flooring: Durable, easy-to-maintain options ideal for residential uses.

· Engineered Wood Flooring: Premium wood-based floors offering natural aesthetics combined with modern durability.

· Vinyl Flooring (LVT): Highly durable and water-resistant floors suitable for both residential and commercial applications.

· All products are eco-friendly (non-PVC options available). They offer multiple design options across basic, classic, and trendtime product lines.

1) What was the problem that led to the underperformance of the segment?

· The ongoing war between Russia and Ukraine has created a shortage of raw materials, which sent the costs of raw materials to record high levels.

· The energy and gas crisis in Europe, and the recession in Germany/Austria which was their key market, resulted in the de-growth of the industry (10% on volume basis). Building solutions is more of a discretionary expenditure.

· High inflation dampened consumer spending on renovations and DIY projects.

· Costs of materials like HDF (High-Density Fiberboard) doubled due to supply chain issues.

2) What steps were taken by the management to address the problem?

· Entering new markets through joint ventures in China, Spain, the UK, India, and the USA. Expanding sales in neighboring European countries like the UK, France, Spain, Italy, and Nordic countries. The flooring market in the US is around $12-14 bn.

· Shifting strategy from distributor-led sales to more DIY store sales and e-commerce (focusing on digital presence).

· Shift to high-margin product: launched 164 new SKUs (20% of the existing portfolio)

System Sales Approach: Instead of standalone product sales, Parador has adopted a system sales approach. This strategy involves offering comprehensive flooring systems tailored to specific customer needs, which inherently carry higher margins due to the value-added services and technology integration.

· Securing long-term contracts for raw material supply: Parador entered strategic long-term contracts with key suppliers of HDF/MDF to ensure consistent raw material availability. This approach is expected to mitigate the risk of sudden shortages caused by supply chain disruptions or geopolitical events, which previously eroded their margins.

· Increased spending on people and advertisement side – going aggressively to gain market share when the whole industry is struggling broadly (degrowth of 10%)

3) What do markets want to see?

The market likely expects Parador to demonstrate sustained volume growth, continued margin improvement, and progress on its long-term revenue targets as the European market recovers.

4) Key risks:

Key risks for Parador’s strategy:

· Market Dominance by Local Players: In many of the new regions Parador is targeting (e.g., Spain, the UK, France, Switzerland, and China), there are well-established flooring companies with deep local market knowledge, robust distribution networks, and strong customer relationships. Competitors like Mohawk Industries, Tarkett, and Shaw Industries dominate the global flooring market and are known for their diverse product portfolios and innovative practices. It would be so hard for Parador to capture market.

· Customer Loyalty: There is a good possibility that customers in these regions may already have strong brand loyalty to local or regional players, making it challenging for Parador to gain traction.

· Efforts in building brand: We need to consistently track the efforts to build a brand by Parador in their new markets. It will require heavy upfront spending on advertising, sales & support, and research initiatives.

· We do not know, if the efforts they are putting in Parador are enough or not. Only numbers will tell.

Macroeconomic challenges:

· The fate of Parador is dependent upon the recovery of the growth in the EU, specifically Germany. It can take years to see the recovery, which would translate into Parador’s revenue. In the end, the management cannot fight the economic forces.

5) Opinion:

· While the worst is behind for the Parador, it does not mean recovery. Their fate is tied to economic recovery, which can take years to materialize.

C) Building solutions:

Context:

· The Building Solutions segment primarily caters to the demand for dry walling solutions, including AAC blocks, boards, and panels.

· Key challenges include rising raw material costs (cement, fly ash) and logistical pressures.

· Strategic focus on Tier-2 and Tier-3 cities using heat maps to identify demand hotspots.

· Acquired the AAC block manufacturing facility of Fastbuild near Cuttack, Odisha.

· HIL is targeting a revenue milestone of INR 750–800 crore for this segment over the next 3–4 years, up from INR 400 crore in FY23, with sustainable EBITDA margins of above 10%.

· Finolex Industries management views Building & Construction as a fast-growing industry with expectations of 15-20% growth over the next 5-10 years.

Customer:

· They are primarily a B2B-focused business, catering to builders, contractors, and large-scale infrastructure projects.

· Their customers include Residential construction (homebuilders), Commercial spaces (offices, malls, etc.), and Infrastructure projects requiring drywalling solutions.

Competition:

· HIL faces competition from both organized players and local manufacturers in the AAC blocks, boards, and panels space.

· This is more of a space that lacks moat, in other words ‘brand’ name do not differentiate one player from other, because there are already many players.

· HIL aims to leverage its strong brand reputation (Birla brand) and high-quality products to differentiate itself

Products:

· AAC Blocks: Lightweight building blocks used in construction

· Boards: Non-asbestos boards used for drywalling

· Panels: Sandwich panels used for partitions in commercial spaces

1) What were the challenges faced by the segment?

· Their buildings segment did not face any significant challenges in the past, except capacity constraints. However, going forward they are more concernment about the rise in prices of Cement (their key raw material) putting pressure on margins.

· HIL’s existing plants for AAC blocks, boards, and panels were operating at 100% utilization, limiting the ability to meet growing demand.

· Elevated shipping costs for raw materials like cement and fly ash added to operational expenses

2) Key actions taken by the management:

· Strengthened presence in Eastern India through acquisitions and capacity enhancements.

· Transitioned from product sales to system sales

· The company is going aggressive in Eastern India, and focusing on that region, by planning to manufacture on a large scale

D) Roofing solutions (Charminar):

HIL Limited is the largest manufacturer of fiber cement roofing solutions in India, with a market share of approximately 24.7% in this category. The company operates under its flagship brand Charminar, which has become synonymous with durable and high-quality roofing products. HIL's roofing solutions are designed to provide durability, weather resistance, energy efficiency, and eco-friendliness.

HIL operates 25 state-of-the-art manufacturing facilities globally (including two in Europe), ensuring high-quality production standards.

HIL’s right to win:

· HIL Has an industry-leading 60% tehsil penetration in the country for its roofing business.

· They operate over 40 depots and have more than 8000 stockists and distributors across India

· Charminar brand is known for its quality, reliability, and customer trust built over decades

· HIL is well-positioned to benefit from government initiatives like Pradhan Mantri Awaas Yojana Gramin (PMAYG) and the potential revival of the rural economy.

· They are India’s largest manufacturer of fiber cement roofing solutions.

· HIL’s right to win in the Roofing solutions is built on its market leadership, strong brand reputation, innovation, and high penetration in the Tehsil area.

1) What was the problems faced by the roofing segment in recent quarters?

· Sluggish demand: The roofing market experienced a slow start to the season, particularly in Q1 FY25, due to the general elections and adverse weather impact.

· Pricing pressure: The segment faced intense price competition, especially from smaller regional players, leading to a decline in price realization of about 1-2%.

· Margin compression: The combination of pricing pressure and raw material cost increases led to margin compression in the roofing segment.

· Market dynamics: Capacity expansion by competitors led to more aggressive volume-led sales strategies, putting additional pressure on prices

2) What were the steps taken by the HIL Limited to address these issues?

· Introduced new roofing products like UltraCool roofs and a new line of roofing accessories to differentiate its offerings and maintain a price premium over competitors.

· Focused on cost optimization measures, including sourcing efficiencies and logistics improvements, to offset the impact of rising raw material costs like fiber.

· Strengthening relationships with distributors and retailers through enhanced marketing and engagement efforts to drive sales in competitive markets.

3) What does market want to see?

· Despite a slow start to the season due to elections, the market expects both volume and price growth in roofing, leading to stronger margin performance.

· The company has guided for margin improvement of 200-300 basis points year-on-year in FY25 for the roofing segment.

4) Risks:

· Pricing pressure and no uptick in demand from delayed government spending

The reverse DCF approach to valuation (Price implied expectations)

A) Sensitivity analysis of revenue growth, EBITDA margins, and EV/EBITDA multiples:

Analysis of the table:

· The company aims to achieve 17-20% revenue growth to hit a $1 bn topline (INR 8400 crores) with 10-12% EBITDA margins over the next 3-4 years.

· Even if the company fails to achieve its target of $1 Bn with 10-12% EBITDA margins, and settles for revenue in the range of INR 7000-7500 crores with EBITDA of 8% they will still earn EBITDA in the range of 600-750 crores.

Analysis of the table:

· To earn an IRR of 25% over the next 4 years, on the current EV of 2700 crores, the target EV would be 6600-6800 (given they do not increase it via taking too much debt).

· For a company like HIL, a 15-20% growing company deserves an EV/EBITDA multiple of 13-15x.

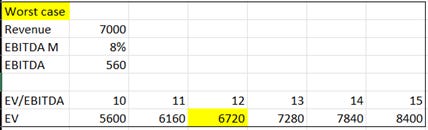

Worst case scenario:

· Considering they fall short of achieving their revenue target and touch the EBITDA margins of 8%. Still to earn an IRR of 25% (target EV – 6700 crores), the market should be valuing them at EV/EBITDA of 12, which does not sound like a rich multiple.

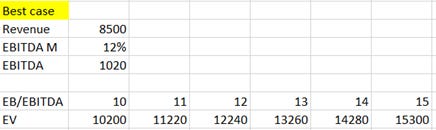

Best case scenario:

If they achieve what they are aiming for, then yes, we can achieve much more than IRR of 25%

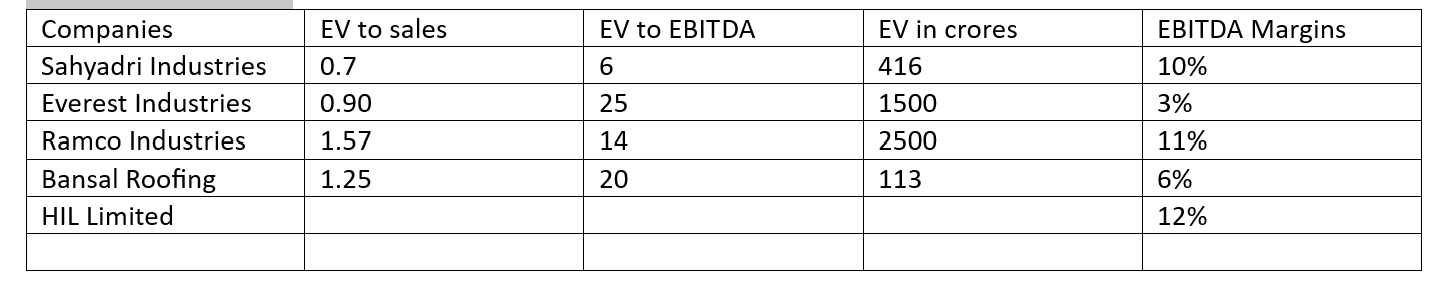

Peers group:

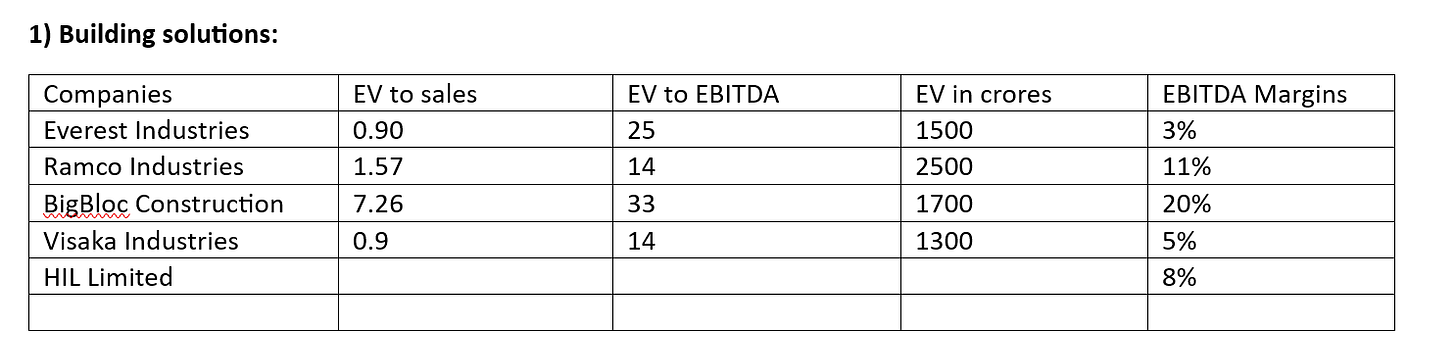

1) Building solutions:

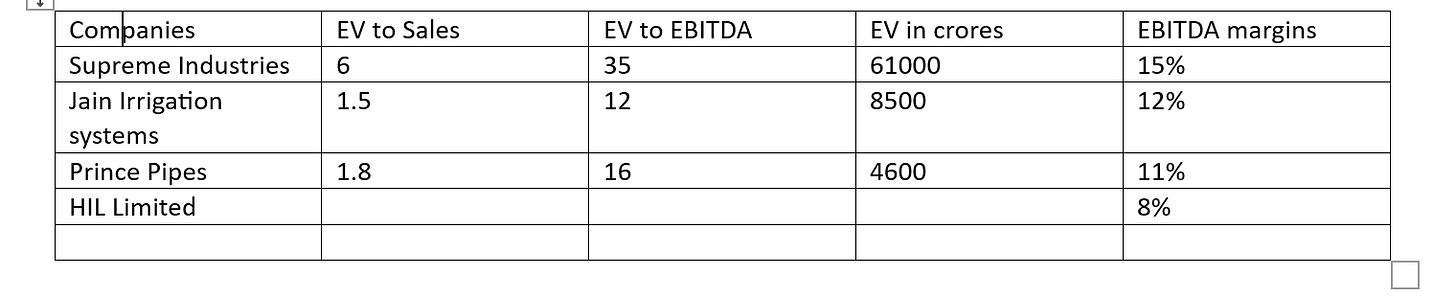

2) Pipes & Fittings:

3) Roofing solutions:

Views on Management quality:

1) On capital allocation:

After studying multiple cycles, I have noticed one pattern that sub-par management enters the downcycle with a lot of debt or balance sheet problems, while a good capital allocator enters the downcycle with negligible debt, and he looks to acquire other beaten down players at dirt-cheap valuations. Examples: Real Estate sector around 2016, Hotel Sector around 2017, Capital goods sector around 2014-16, and currently same is getting played out in Cement sector, where players with balance sheet problems are getting acquired by big players at replacement costs.

(there are not many direct listed competitors, so I cannot back it up with numbers, but numbers are there for last cycles, which can shed light on behaviour of management and how they allocate capital)

HIL Limited, probably we can that we are witnessing near bottom part of the cycle (worst margins), they made pretty good acquisition, betting aggressively on Parador when the whole industry is facing immense painful periods, and yet they do not have any balance sheet problems.

Conclusion: They are not a bad capital allocator, if not the best one.

2) On strategy:

When the whole industry is facing downturn, they are getting aggressive in their approach by investing heavily on acquisitions (Crestia), expanding product portfolio, and entering new geographies (Parador), increasing sales & support staff. This is a positive sign.

3) Execution skills:

While they are putting great number of efforts, the management are competent in terms of their background and formal education, the numbers are yet to come as it depends on the recovery. But they do execute and take actions according to what they say.

Viewpoint :

The investment opportunity for HIL Limited can be viewed from two distinct perspectives. For long-term investors who focus primarily on business fundamentals and management execution, HIL presents an attractive buying opportunity at current valuations, despite the possibility of experiencing extended periods without significant returns. However, from a more tactical investment approach that emphasizes price action and risk management over news flow, it would be prudent to wait for clear positive price momentum before making any substantial investment. This second approach acknowledges that while the business fundamentals may be improving, market validation through price action would provide additional confirmation before committing significant capital.

Disclaimer - We are not SEBI registered Investment Advisors , Any post should be not construed as an advise. This is a just an individual research for personal investments.

Nicely written. In my humble opinion it is Parador that will eventually move the needle in this becoming a multi baggar (5-7x) vs. 2x from here in the next cycle (if Parador remains a drag). Parador is where segmental ROCE is -18% and Parador will be 40-50% business revenue in mgmt. guidance for $1B (and where mgmt.'s majority focus is).

Also when i went through the concalls/annual report it jived with what I liked with Eureka forbes (they are sacrificing near term margins and investing in people, product and process). Akshat has been with the company for only 15 months (he is with the birla group for a decade) but his articulation of issues with the company and the steps they are taking and his articulation of his vision impresses me. There are multiple challenges as well but the current valuation gives enough margin of safety.

I actually did 35% of my total allocation this week sub 1700 INR. Like you said this is valued as a commodity non growing company (for obvious reasons) but I think there is enough margin of safety to start staggered deployment here. I also go 30% of my targeted allocation in eureka Forbes last week of Feb at around 475.. I really my pota and finally finding some comfort in entry valuations there.

Hello Deepak

First of all thanks for your detailed write up fantastic work done congratulations on this

What is your view after Quarterly results & conference call, one of the participants raised Qn on company sales strategy wrt pipes that you are gaining market share bcos other players are avoiding sales at a loss, how do you look this & secondly they are also changing brand names so definitely it will again deplete cash and cash profits will reduce if this resolution gets passed

Thanks

Divyansu K Taneja